Nordic IPO boom to continue into 2022 as investment banks fight for market share – S&P Global

Thank you for your interest in S&P Global Market Intelligence! We noticed you’ve identified yourself as a student. Through existing partnerships with academic institutions around the globe, it’s likely you already have access to our resources. Please contact your professors, library, or administrative staff to receive your student login.

At this time we are unable to offer free trials or product demonstrations directly to students. If you discover that our solutions are not available to you, we encourage you to advocate at your university for a best-in-class learning experience that will help you long after you’ve completed your degree. We apologize for any inconvenience this may cause.

Fill out the form so we can connect you to the right person.

If your company has a current subscription with S&P Global Market Intelligence, you can register as a new user for access to the platform(s) covered by your license at Market Intelligence platform or S&P Capital IQ.

Thank you.

One of our representatives will be in touch soon to help get you started with your demo.

We generated a verification code for you

Nordic IPO boom to continue into 2022 as investment banks fight for market share

Post-webinar Q&A: Global Credit Risk Trends 2021 and Beyond

University Essentials: From Crisis to Resilience – Navigating Sustainable Recovery

EV impact; vaccines to boost job market; coal supply constraints

Shore Capital is Now Available in S&P Global’s Aftermarket Research Collection

A Nordic IPO frenzy in 2020 and 2021 is set to continue into next year with larger deals, more main market listings and international investment banks increasingly seeking opportunities in the region.

The IPO market in the Nordic region has flourished in recent years due to a thriving startup scene, less cumbersome regulation and a deep pool of institutional and retail investors, which make it possible for smaller companies to seek capital through a stock market flotation.

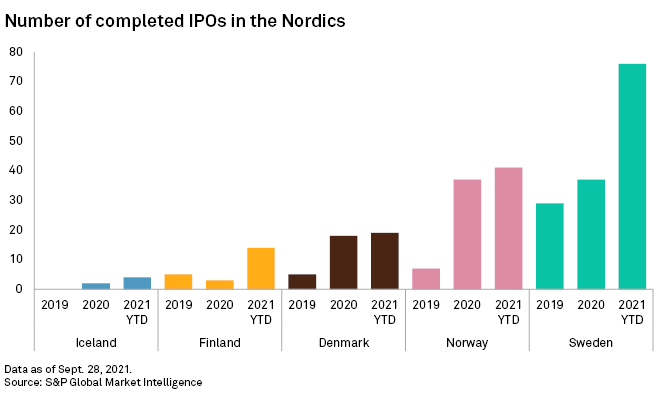

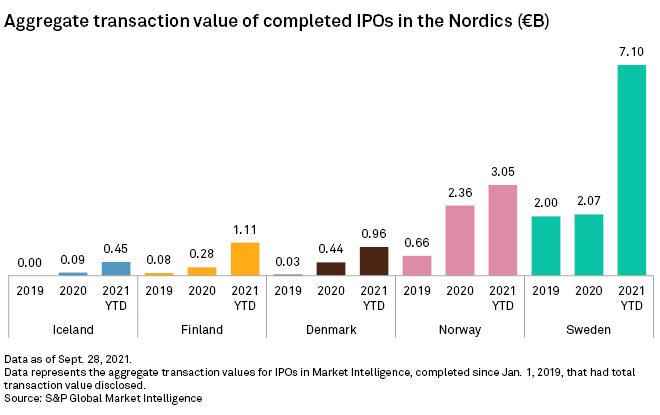

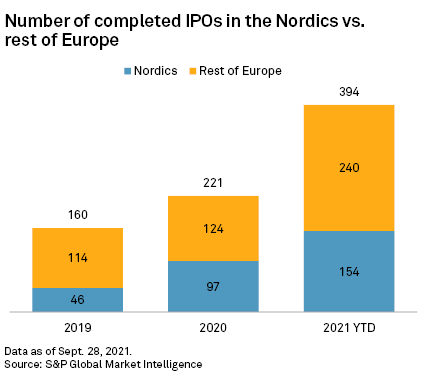

The COVID-19 pandemic appears to have accelerated the trend. The total number of IPOs in Sweden, Norway, Denmark, Finland and Iceland grew by more than 110% in 2020 and has risen almost 260% year over year so far in 2021, according to S&P Global Market Intelligence data as of Sept. 27. More than 40% of European IPOs in 2020 and 2021 have taken place in the Nordic countries.

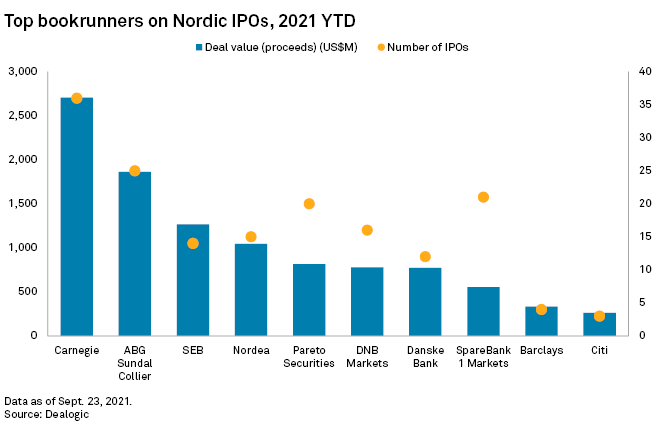

While international investment banks led the Nordic IPO bookrunner ranking in 2019, they have since been far surpassed by regional investment banks such as Carnegie Investment Bank AB (publ) and ABG Sundal Collier Holding ASA, which have gained respective market shares of 20.5% and 14.1% this year, up from 7.5% and 1.9% in 2019, according to data as of Sept. 23 from Dealogic, an analytics provider.

JPMorgan Chase & Co. and The Goldman Sachs Group Inc., which were among the top three bookrunners on Nordic IPOs in 2019, now rank 17th and 23rd, having seen their market shares drop over the same period to 1.0% and 0.6% from 10.2% and 7.7%, respectively, according to Dealogic.

Need for speed

Nordic investment banks have been early movers in embracing technology and implementing fully virtual roadshows during the pandemic, which has increased productivity and freed up capacity, enabling them to work on more IPOs than ever before, said Jonas Ström, CEO at ABG Sundal Collier.

„We can meet all investors of relevance in five days instead of having three weeks on the road,“ Ström told Market Intelligence.

Norwegian video conferencing company Pexip Holding ASA provided a „proof of concept“ for others to follow when it went public in May 2020 after a fully digital roadshow, leading to a subsequent boom in IPOs, said Anne Lise Gryte, capital markets partner at Norwegian law firm Wiersholm, in an interview.

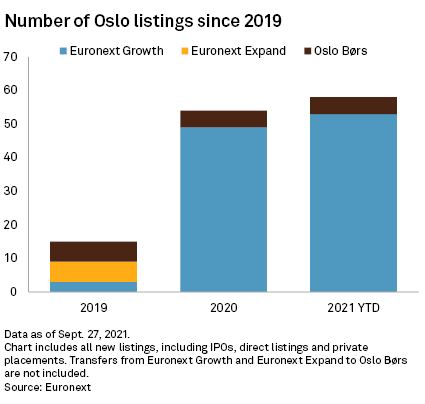

Another key driver of Nordic IPOs since 2020 is the Euronext Growth Market in Oslo, which has attracted record interest amid a need for speed during turbulent market conditions. As opposed to the main Oslo Børs, Euronext Growth is not a regulated market and, as such, imposes fewer obligations and offers a route for smaller Norwegian companies seeking a broader IPO.

„The pandemic-related uncertainties in the market led to this need to move very quickly,“ said Gryte. „And the Euronext Growth became a vehicle for doing these quick listings because the application process is only 10 days, and you can even have it down to five.“

While the Euronext Growth Market has traditionally been used for early-stage companies lacking strong cash flows, the October 2019 listing of Kahoot! ASA, a SoftBank-backed online education company valued at more than 5 billion Norwegian kroner at the time, helped legitimize the growth exchange as a location for major companies to raise capital, Gryte said.

Listings on Euronext Growth increased from just three in 2019 to 49 in 2020, and this number has already been surpassed in 2021, with 55 deals to date, according to Euronext data, which includes all types of new listings, including private placements. Technology-related sectors and alternative energy companies in particular have been driving those figures. Meanwhile, a total of 10 listings have taken place on the Oslo Børs in 2020 and 2021, while Euronext Expand in Oslo, also a regulated market, has hosted none as companies favored the growth market.

Boom into 2022

In Sweden, the pandemic had a greater impact on IPO appetite in the first few months of the crisis, but the slowdown in 2020 only served to fuel „off-the-charts“ numbers in 2021 as activity recovered, said Andreas Dalhäll, IPO leader for Sweden and the Nordics at EY, in an interview.

Sweden has hosted 76 IPOs so far this year, compared with 37 in full year 2020 and 29 in 2019, according to Market Intelligence data. The most active industries for IPOs in the country this year include internet software and services, and pharmaceuticals.

Dalhäll expects the high IPO levels in the Nordic region to continue „well into the first half of 2022.“

„From our standpoint, there is no trend at all of the market slowing down, and we get calls for kickoffs every week now,“ Dalhäll said, adding that the „massive pickup in IPOs“ has even caused a shortage of advisers, with EY having to turn down clients.

While much of the boom has benefited regional investment banks, some international players want to gain a larger slice of the growing pie. JPMorgan, for one, has relocated executives from London to Stockholm and Copenhagen, Denmark, while hiring locally to build its presence on the ground in those locations as it aims to become „the leading corporate and investment bank in the Nordic region,“ Klaus Thune, JPMorgan’s co-head of Nordic investment banking, said by email.

This comes as deal flow in the region shifts toward large and more main market IPOs. „What’s really good to see is that we have a few really big ones coming out in the next nine months, way above US$1 billion. Those are quite scarce,“ Dalhäll said. Such deals will typically involve global investment banks as joint global coordinators, he added.

Swedish investment company Storskogen Group AB (publ), for example, could reach a valuation of approximately 56.4 billion kronor, or $6.4 billion, through its IPO on Oct. 6. Joint global coordinators and bookrunners include Carnegie, Goldman Sachs and JPMorgan.

ABG’s IPO pipeline has shifted to „more traditional industries“ and companies with stable cash flows, Ström said, while the bank is taking „a bit of a pause in terms of high-growth companies with cash flows in the far distant future.“

„A lot of traditional industries were to some extent more affected by the negative effects of the pandemic. And the strong companies with good business models have now had some time to prove themselves, so now is the time for them to engage in discussions with investors in terms of raising capital,“ Ström said.

The move toward main market listings is in part driven by changing demands from investors, who have now „filled up their portfolios with growth [companies],“ said Gryte.

She expects a hike in uplistings from the Euronext Growth Market to the main Oslo Stock Exchange in December, January and February, as many growth companies have committed to doing so within a year of their IPO. So far in 2021, 10 companies have transferred to the main market, up from four in the full year of 2020, according to Euronext.

SPAC listings, in which special-purpose vehicles raise money through an IPO with the purpose of acquiring an existing company, will be another driver of IPO growth in the region in the coming months, according to Dalhäll.

In Norway, where the regulator has not yet permitted SPACs listings but is currently assessing the matter, Gryte said Wiersholm has „a lot of clients who are looking at the opportunities of listing SPACs,“ and she expects this type of listing to become a market in the country.